The CDS Pricer is an application build upon the ISDA Standard CDS pricing model. The application provides the user with a portable easy to use calculator for converting the conventional spread into it equivalent Upfront cost as well as providing the Clean Price, CR01 (credit risk 1bp bump) and IR01 (interest rate 1bp bump).

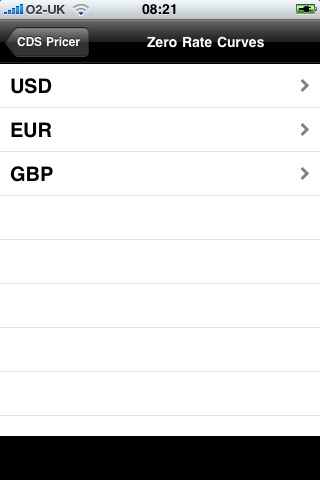

As well as details about CDS contract the model also requires a Rates Curves for the currency being used to value the CDS. These rate curves must be maintained manually by the user via an option on the navigation bar. At this time it is possible to upload a rate curve from the internet but this curve is not dynamic and simply update periodically. In time I will look at way of keeping these rate curve updated and aligned with the market.

Once a rate curve has been modified and is deemed correct the user can select the curve from the main picker along with the desired fixed coupon spread and maturity. The top of the screen allows you to input the notional, recovery rate and conventional spread.

There is not calculate button as the analytics are calculated automatically whenever the inputs change.